Market Volatility - Friend or Foe?

Dollar cost averaging techniques can be used to turn market volatility into a benefit for your investment results

For investors taking withdrawals, it is important to take action to negate the harmful impacts of volatility to your investment plan

“You make most of your money in a bear market, you just don’t realize it at the time.”

- Shelby Cullom Davis

Stock market volatility can sometimes get investors shaken up. Seeing large fluctuations in account values can cause stress for some people. Wouldn’t it be nice to use this volatility to our advantage? To turn a foe into a friend? We should always strive to buy low and sell high but that’s easier to do with careful planning. If you are actively withdrawing from your investment account or plan to soon in the future, you may want to skip to the retirees section.

Savers - Dollar Cost Averaging can Profit from Volatility

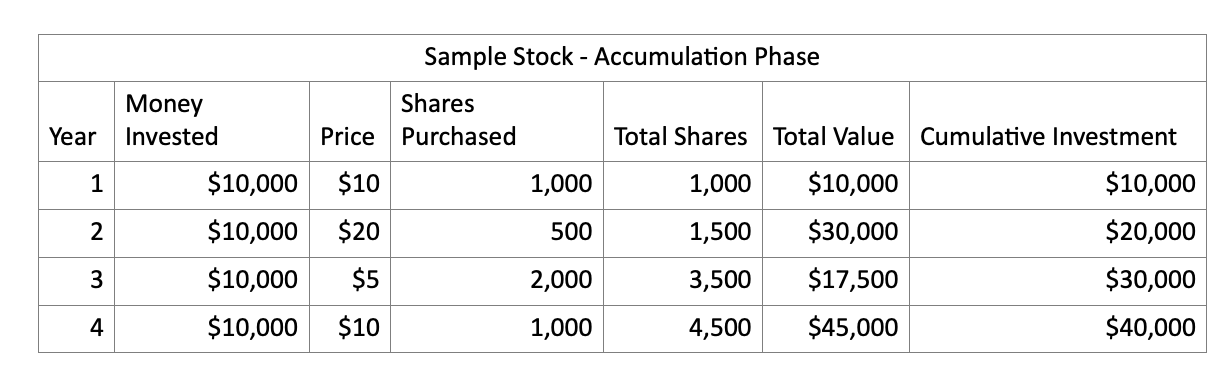

Let me introduce a simple strategy called dollar cost averaging. Invest a set amount into your 401k or investment account buying into your investment allocation at set intervals. When market prices are high, your deposit will purchase less shares. When market prices are low, it will buy more. In the chart below I outline how a $10,000 yearly investment could yield positive investment returns even if the market ends up where it started in 4 years by simply using this strategy to harness market volatility to your advantage. In this example, the investor would profit by $5,000 (12.5%) or over the course of 4 years by sticking to this simple strategy. I cannot tell you where the market is headed in the next year or two, but I can tell you that prices will go up and down on the way to getting where it’s going. So if you are working towards saving up for a future goal, we encourage you to set up regular contributions.

Retirees – Avoiding the Pitfalls of Reverse Dollar Cost Averaging

For investors taking regular withdrawals from their account, regular investment sales suffer from volatility. Selling investments at regular intervals results in the sale of more shares when prices are low and less when prices are high. If we adjust the scenario slightly withdrawing 5% of the original investment each year with the stock finishing 15% higher by the 4th year compared to the first, we lose $955 in total to the volatility bug. Without the sales, we would have 4,000 shares times $11.5 = $46,000. We took $6,000 out over the final 3 years but now only have $39,045. So how do we mitigate this damage?

Retirees – Mitigate the Volatility Bug Using Dividends

If instead, we invested in dividend stocks paying a 5% dividend and took our $2,000 in the form of dividends then we can avoid getting penalized by volatility. It allows us to avoid selling more shares at low prices. If the stock simply finishes where it started our account value stays the same because we never sold any shares. By creating our income through dividends rather than stock sales, we don’t lose value through volatility in between. Importantly both of these examples feature stocks that produce total returns of 20% over the same time period, yet the result is different.

At Aurora Financial Strategies, we design investment portfolios to take advantage of this phenomenon. We recommend consulting with your financial advisor to ensure that your investment strategy is aligned with your goals.

Caveat

If investing in a lump sum is an option, there are other items to consider. In a bull market, a lump sum strategy would likely outperform a dollar cost averaging strategy. For most investors, an allocation to fixed income and other investments are a necessary part of diversification (to complement your stock portfolio) and an additional source of liquidity. In any case, it is best to consult with your financial advisor to determine the best strategy for your specific situation.

In Summary

Volatility can be a friend or foe in your pursuit of your financial goals. It is important to ensure your investment strategy is designed to either harness the benefits or negate the drawbacks of volatility depending on your situation. This blog represents our thinking at the time of publication. If you are a DIY investor, use this only as a starting point for your research and be sure to do your own due diligence. For questions regarding our individual stock strategies, please reach out to us!

Invest Curiously,

Austin Crites, CFA

Austin Crites is the Chief Investment Officer of Aurora Financial Strategies, a financial advisory firm based out of Kokomo, IN. He can be reached via email at austin@auroramgt.com. Investment Advisory Services are offered through BCGM Wealth Management, LLC, a SEC registered investment adviser. This blog does not constitute advice. This is not an offer to buy or sell securities. Advisor is not licensed in all states. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. BCGM Wealth Management, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Clients may own positions in the securities discussed.